21 Sep Current-Value Accounting I Concepts SpringerLink

For example, if you are due to receive $1,000 five years from now—the future value (FV)—what is that worth to you today? This value captures the maximum amount the entity would lose if the asset is disposed of. Prudence is introduced in support of the principle of neutrality for the purposes of faithful representation. Prudence is understood here as the exercise of caution when making judgements under conditions of uncertainty. Users find this concept important as they feel that it should help counteract the natural optimistic bias of management.

What is a company’s accounting value?

However, it also shows how it can increase the volatility of reported assets, equity, and earnings due to fluctuations in market prices. Current value accounting, also known as fair value accounting or mark-to-market accounting, is a method of accounting that measures and records the value of an asset or liability based on its current market price, rather than its original cost. The principle behind this approach is to provide a more accurate and up-to-date financial picture of a company.

Do you own a business?

Under historical cost accounting, this property would continue to be recorded on XYZ Corp.’s balance sheet at its original cost of $1 million, regardless of its current market value. Under the historical cost doctrine, assets are generally carried on the balance sheet at their acquisition cost (adjusted for depreciation and, in some cases, impairment), and liabilities are usually carried at the prices at which they were incurred. For many years this model, which reflects the profession’s traditionally conservative approach, was sufficient. For example, Company ABC bought multiple properties in New York 100 years ago for $50,000. If the company uses mark-to-market accounting principles, then the cost of the properties recorded on the balance sheet rises to $50 million to more accurately reflect their value in today’s market.

What are the benefits of using the current value accounting method?

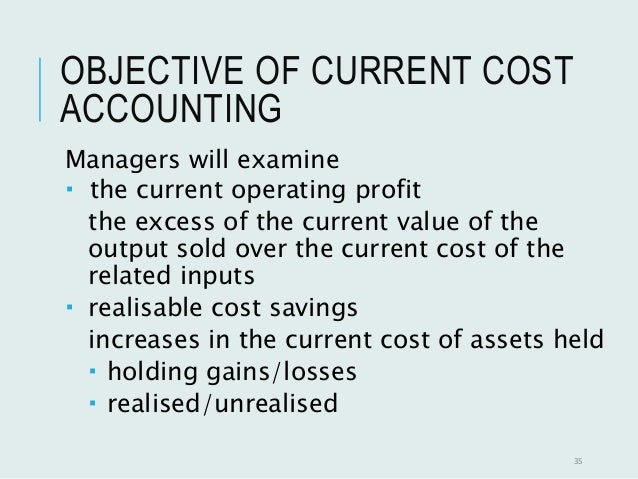

Her comments seem to suggest that trusting companies with a fair market valuation method is akin to asking the proverbial fox to guard the chicken house. Because if the results of a market-value project undertaken by the American Institute of Certified Public Accountants (AICPA) are any indication, a lot of companies aren’t really interested in migrating to a mark-to-market approach. Current value accounting requires the periodic up-dating of values (of assets and liabilities) to keep pace with new market reality and other entity-specific developments.

It is determined by discounting the future value by the estimated rate of return that the money could earn if invested. Present value calculations can be useful in investing and in strategic planning for businesses. In other words, this concept calls for measuring assets at the current value at which they could be sold or disposed of as of the current date, and liabilities at the current value at which they could be settled (repaid) as of that date. Under generally accepted accounting principles (GAAP) in the United States, the historical cost principle accounts for the assets on a company’s balance sheet based on the amount of capital spent to buy them.

Historical Cost Vs. Current Cost: Accountants Wrestle with Reporting Question

- Many might feel that the properties’ worth in particular, and the company’s assets in general, are not being accurately reflected in the books.

- Fortunately, you can easily do this using software or an online calculator rather than by hand.

- Examples of accounting principles include the revenue recognition principle, the matching principle, the consistency principle, the principle of conservatism, and the objectivity principle.

The price at which an asset would be exchanged between knowledgeable and willing parties in an arm’s length transaction. Mark-to-market accounting can make profits look higher, which is sometimes preferred if managerial bonuses are based on profit numbers. This is a new section, containing the principles relating to how items current value accounting should be presented and disclosed. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. One way to do this is by using the book-to-price ratio, which is a measure of the market value of a company relative to its book value.

In contrast, with historical cost accounting, the costs remain steady, which can prove to be a more accurate gauge of worth in the long run. The accounting treatment of this is unchanged, but the Framework now explains that the carrying amount of non-financial items held at historical cost should be adjusted over time to reflect the usage (in the form of depreciation or amortisation). Alternatively, the carrying amount can be adjusted to reflect that the historical cost is no longer recoverable (impairment). Financial items held at historical cost should reflect subsequent changes such as interest and payments, following the principle often referred to as amortised cost. It is useful to users to understand that the general purpose financial statements are prepared on the assumption that the reporting entity is a going concern.

As shares trade, investor demand creates the appropriate bid and ask prices, or market value, and influences each investor’s fair value estimate. Fair value is a measure of a product or asset’s current market value and a reflection of the price at which an asset is bought or sold when a buyer and a seller freely agree. A company’s accounting value is the value of its assets minus the value of its liabilities.

The mark-to-market method of accounting records the current market price of an asset or a liability on financial statements. By using contemporary and market-based measurements, mark-to-market accounting aims to make financial accounting information more updated and reflective of current real market values. While current value accounting can provide a more realistic assessment of a company’s financial position, it also has its challenges. The main one is that market prices can fluctuate significantly over time, which can lead to large swings in the reported value of assets and liabilities, and consequently in reported earnings. This can make a company’s financial results appear more volatile than they would under historical cost accounting.