01 Jun Dividend Payments: What Are They, and Where Do They Come From? The Motley Fool

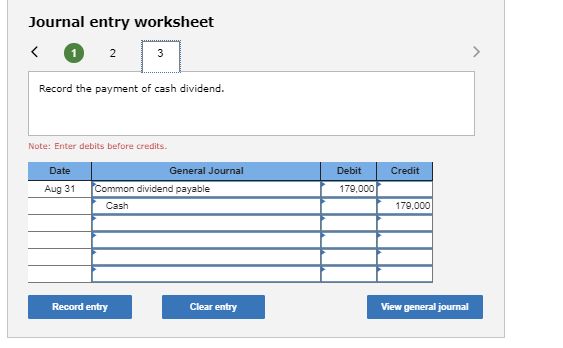

Hence, the company needs to make a proper journal entry for the declared dividend on this date. Instead, it creates a liability for the company, as it is now obligated to pay the dividends to its shareholders. This liability is recorded in the company’s books, reflecting the company’s commitment to distribute earnings. It is important to note that once declared, dividends become a legal obligation, and the company must ensure that it has sufficient liquidity to meet this commitment without jeopardizing its operational needs. Dividend payments are a critical component of the financial strategies for many companies, representing a tangible return on investment for shareholders. The process of recording these transactions is not merely a clerical task but an essential element of corporate accounting that ensures accuracy in financial reporting and compliance with regulatory standards.

Explained: All the steps Donald Trump will take for return to Oval Office

Funds employ the principle of net asset value (NAV), which reflects the valuation of their holdings or the price of the assets that a fund has in its portfolio. The company’s management may have a plan for investing the money in a high-return project that could magnify returns for shareholders in the long run. Understanding how dividends impact both corporations and investors provides insight into broader economic trends and individual investment decisions. This topic delves into the mechanics behind dividends, their various forms, and the consequential tax considerations, all of which shape the decision-making process for businesses and investors alike. Cumulative preference shareholders can accumulate the dividend yearly, even though the company has not declared the dividend. As a result, they will receive a dividend for the past years for which the dividend was undeclared in the year of declaration.

How are dividends paid out?

Main Street, through its wholly owned portfolio company MSC Adviser I, LLC (“MSC Adviser”), also maintains an asset management business through which it manages investments for external parties. MSC Adviser is registered as an investment adviser under the Investment Advisers Act of 1940, as amended. Miranda Marquit has been covering personal finance, investing and business topics for almost 15 years. She has contributed to numerous outlets, including NPR, Marketwatch, U.S. News & World Report and HuffPost. Miranda is completing her MBA and lives in Idaho, where she enjoys spending time with her son playing board games, travel and the outdoors. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer.

Investing Basics: What Are Dividends?

The declaration and distribution of dividends have a consequential effect on a company’s financial statements. The balance sheet, income statement, and statement of cash flows all exhibit the impact of these transactions in different ways. The balance sheet as a dependent will show a reduction in cash or an increase in common stock and additional paid-in capital, depending on whether cash or stock dividends are issued. The reduction in retained earnings is also reflected here, indicating a decrease in shareholders’ equity.

Small Stock Dividend Accounting

The Company is pleased to announce that its Board of Directors has declared a cash dividend in the amount of $0.0048 per common share for the third quarter of 2024. The dividend will be paid to holders of record of First Majestic’s common shares as of the close of business on November 15, 2024, and will be paid out on or about November 29, 2024. Dividend record and payable dates are important to monitor since they relate to when dividends are paid out to investors from an investment. The record date of an investment dividend refers to the date that the corporation’s board of directors sets as the deadline for investors to be counted on the company’s books. The payment date is the culmination of the dividend timeline, representing the day when shareholders receive their dividends. This moment is eagerly anticipated by investors as it signifies the realization of financial rewards and the cash payment of the dividend.

- For example, on March 1, the board of directors of ABC International declares a $1 dividend to the holders of the company’s 150,000 outstanding shares of common stock, to be paid on July 31.

- A sample presentation of the dividends payable line item in a balance sheet appears in the following exhibit.

- If a company sees its share price remain the same or increase on or after a payment date, it can indicate that there is higher market demand for the stock.

- The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable account.

- As you would expect, dividends shouldn’t impact the operating activities of your company.

That means declaring, paying, and recording dividends won’t change anything on your income statement or profit and loss statement. The Dividends Payable account records the amount your company owes to its shareholders. In the general ledger hierarchy, it usually nestles under current liabilities. The Board’s declaration includes the date a shareholder must own stock to qualify for the payment along with the date the payments will be issued.

To record the declaration, you’ll debit the retained earnings account — the company’s undistributed accumulated profits for the year or period of several years. A company will declare the amount of the dividend and all relevant dates if dividends are to be paid. All holders of the stock before the ex-date will then be paid accordingly on the upcoming payment date. Investors who receive dividends can typically choose to take them as cash or as additional shares.

For the investor, stock dividends offer no immediate payoff but may increase in value over time. Of course, the investor can simply sell the extra shares and collect the cash. A stock dividend is a reward for shareholders made in additional shares instead of cash. The stock dividend rewards shareholders without reducing the company’s cash balance. It has the adverse effect of diluting earnings per share, at least temporarily. Unlike cash dividends, stock dividends are not taxed until the investor sells the shares.

Dividend record date is the date that the company determines the ownership of stock with the shareholders’ record. The shareholders who own the stock on the record date will receive the dividend. Dividend is usually declared by the board of directors before it is paid out. Hence, the company needs to account for dividends by making journal entries properly, especially when the declaration date and the payment date are in the different accounting periods. After your date or record, your liabilities will increase and your retained earnings will decrease.

If a company has one million shares outstanding, this would translate into an additional 50,000 shares. A shareholder with 100 shares in the company would receive five additional shares. Issuing share dividends lowers the price of the stock, at least in the short term. A lower-priced stock tends to attract more buyers, so current shareholders are likely to get their reward down the road. Or, they can sell the additional shares immediately, pocket the cash, and still retain the same number of shares they had before. A high-value dividend declaration can indicate that a company is doing well and has generated good profits.

As a practical matter, the difficulty of reversing a declaration makes the payment unavoidable for a going concern and the liability treatment is appropriate. Dividends are seen by many investors as a sign that a company is earning a healthy profit and, more to the point, is willing to share it with its investors. Many countries also offer preferential tax treatment to dividends, treating them as tax-free income.